How the money system works, part 3 – summary and consequences

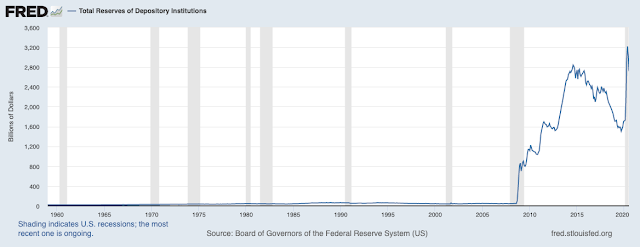

This has been a dry and technical discussion so far. But everyone should take the time to understand it, because the political and economic consequence are immense. Before explaining why, let’s recap. When a bank creates a loan it creates both an asset (a claim for payment on the borrower) and a liability (the borrower’s deposit). This liability amounts to a promise to deliver bank notes up to the amount of the deposit, or alternatively to use its bank reserves to settle payments made by the deposit, also up to the amount of the deposit. Bank reserves are amounts held by commercial banks in accounts at the central bank. Like commercial bank deposits, they are a promise to provide bank notes on demand. The key difference is that the central bank can create bank notes (or reserves) at will, whereas a commercial bank cannot. When a depositor instructs a bank to move money to an account at another bank, the first bank transfers reserves to the second bank, and the second bank t...